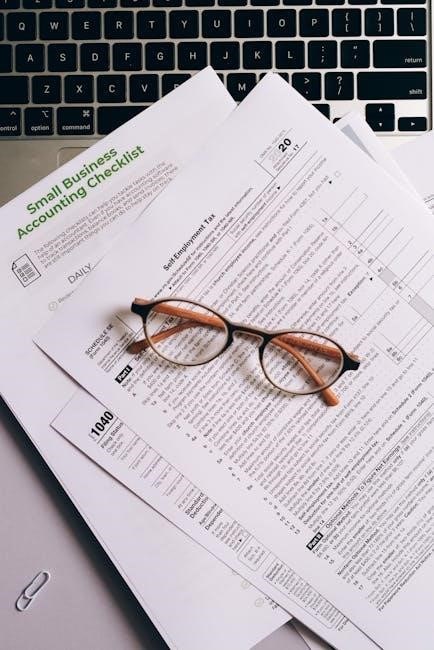

Welcome to the study of fundamental accounting principles, essential for understanding financial reporting and business decision-making. These principles guide the accurate recording and presentation of financial data, ensuring transparency and accountability in accounting practices.

Definition and Importance of Accounting Principles

Accounting principles are fundamental rules and guidelines that govern financial reporting, ensuring consistency, accuracy, and transparency. They provide a framework for recording, classifying, and summarizing business transactions. These principles, such as GAAP and IFRS, are essential for preparing reliable financial statements that stakeholders can trust. Their importance lies in promoting comparability, ethical practices, and accountability, enabling informed decision-making. By adhering to these principles, businesses maintain credibility and comply with legal and regulatory requirements, fostering confidence in financial markets and supporting economic growth.

Historical Development of Accounting Standards

The evolution of accounting standards began with the double-entry system in the 15th century, laying the foundation for modern financial reporting. Over time, the need for consistency led to the development of GAAP in the U.S. and later IFRS internationally. These frameworks aim to harmonize accounting practices globally, ensuring comparability and transparency. Historical milestones include the establishment of the Financial Accounting Standards Board (FASB) in 1973 and the International Accounting Standards Board (IASB) in 2001. These bodies continuously update standards to reflect economic changes and enhance financial reporting quality, fostering trust and accountability in global markets and economies.

Key Fundamental Accounting Principles

Fundamental accounting principles include GAAP, IFRS, relevance, comparability, and transparency, ensuring accurate and consistent financial reporting. These principles guide the preparation and interpretation of financial statements effectively.

GAAP (Generally Accepted Accounting Principles)

GAAP stands for Generally Accepted Accounting Principles, a framework of rules and guidelines for financial reporting. It ensures consistency, transparency, and comparability in financial statements. GAAP principles include cost, revenue recognition, and full disclosure, providing a standardized approach to accounting practices. These principles are essential for businesses to prepare accurate and reliable financial reports, fostering trust among investors and stakeholders. By adhering to GAAP, companies ensure their financial data is presented fairly and consistently, facilitating better decision-making and accountability in the marketplace.

GAAP is widely adopted in the U.S. and is continuously updated to reflect evolving business practices and regulatory requirements.

IFRS (International Financial Reporting Standards)

IFRS (International Financial Reporting Standards) is a global framework for financial reporting, enabling consistent and comparable accounting practices worldwide. Issued by the International Accounting Standards Board (IASB), IFRS promotes transparency, accountability, and efficiency in financial markets. Key principles include the accrual basis of accounting, going concern assumption, and fair value measurement. IFRS emphasizes the importance of qualitative characteristics such as relevance, reliability, and comparability in financial reporting. Its adoption facilitates cross-border investments and ensures a unified approach to financial statement preparation, benefiting businesses, investors, and economies globally. IFRS continues to evolve to address emerging financial reporting challenges and advancements in business practices.

Relevance and Comparability in Financial Reporting

Relevance and comparability are cornerstone principles in financial reporting, ensuring that financial information is useful and consistent. Relevant information meets the needs of users, enabling informed decisions. Comparability allows stakeholders to evaluate an entity’s performance over time and against competitors. These principles are integral to frameworks like GAAP and IFRS, guiding the preparation of financial statements. They enhance transparency and accountability, fostering trust in financial markets. By emphasizing these qualities, businesses provide stakeholders with a clear and consistent view of their financial health, supporting effective analysis and decision-making. These principles are continuously refined to meet the evolving needs of the financial community.

Qualitative Characteristics of Accounting Information

Accounting information must possess qualitative characteristics like relevance, reliability, comparability, and consistency to ensure decision-usefulness. These traits enhance transparency and credibility in financial reporting and analysis.

Relevance Principle

The relevance principle ensures that accounting information is timely, material, and relevant to users’ decision-making needs. It emphasizes that financial data should be useful for assessing performance and future outcomes, making it indispensable for stakeholders. This principle aligns with the qualitative characteristics of accounting information, as highlighted in fundamental accounting principles PDF resources. By providing timely and pertinent information, businesses enhance transparency and accountability, fostering trust among investors and creditors. The relevance principle is a cornerstone of effective financial reporting, ensuring that data remains meaningful and impactful for all stakeholders involved in economic decisions.

Reliability Principle

The reliability principle ensures that financial information is accurate, verifiable, and free from material errors or bias. It requires that accounting data be supported by credible evidence and consistently applied across periods. This principle prioritizes the faithful representation of transactions, aligning with standards like GAAP and IFRS. Reliable financial reporting builds trust among stakeholders, as they can depend on the information for sound decision-making. By emphasizing accuracy and transparency, the reliability principle strengthens accountability and fosters confidence in the financial statements, making it a vital component of ethical and professional accounting practices.

Comparability Principle

The comparability principle emphasizes the need for consistency in financial reporting, enabling stakeholders to analyze and compare data across periods or entities. It requires that accounting methods and policies remain consistent over time and align with industry standards. This principle ensures that financial statements are presented in a uniform manner, facilitating informed decision-making. By maintaining consistency, businesses enhance the transparency and reliability of their financial data, allowing for meaningful comparisons and benchmarking. This principle is crucial for investors, creditors, and other users who rely on financial information to assess performance and make strategic choices.

Cost-Benefit Principle

The cost-benefit principle states that the benefits of providing financial information should outweigh the costs of preparing and disclosing it. This principle ensures that entities only incur reasonable expenses to generate useful and relevant data. It balances the need for high-quality, detailed financial reporting with practical considerations of resource allocation. By focusing on cost-effectiveness, the principle promotes efficient accounting practices without compromising the usefulness of financial information. This approach supports transparent and ethical reporting, aligning with the overall objectives of fundamental accounting principles to provide stakeholders with reliable and meaningful financial insights.

Financial Statements: Structure and Components

Financial statements include the balance sheet, income statement, and cash flow statement. They present a company’s financial position, performance, and cash flows, ensuring transparency and accountability.

Balance Sheet: Assets, Liabilities, and Equity

The balance sheet presents a company’s financial position at a specific point in time. It categorizes resources into assets, liabilities, and equity. Assets represent resources owned or controlled, such as cash, inventory, and property. Liabilities are obligations owed, like loans or accounts payable. Equity reflects the residual interest in assets after deducting liabilities, often including retained earnings and shareholder contributions. The balance sheet adheres to the fundamental equation: Assets = Liabilities + Equity. It provides insights into a company’s liquidity, solvency, and financial structure, aiding stakeholders in assessing its stability and potential for future growth.

Income Statement: Revenues and Expenses

The income statement summarizes a company’s financial performance over a specific period, detailing revenues and expenses. Revenues are income earned from sales, services, or other business activities. Expenses are costs incurred to generate revenue, such as salaries, rent, and materials. The income statement calculates net income by subtracting total expenses from total revenues. It provides insights into profitability, cost management, and operational efficiency. This financial report is essential for stakeholders to assess a company’s financial health and make informed decisions. Accurate reporting of revenues and expenses ensures transparency and compliance with accounting standards.

Cash Flow Statement: Operating, Investing, and Financing Activities

The cash flow statement tracks a company’s inflows and outflows of cash, categorized into three main activities. Operating activities involve cash from daily operations, such as sales and expenses. Investing activities include purchases or sales of assets like equipment or investments. Financing activities relate to cash flows from debt or equity, such as loans or dividends. This statement provides insights into a company’s liquidity, solvency, and ability to generate future cash flows. It complements the balance sheet and income statement, offering a comprehensive view of financial health and cash management practices.

Accounting Methods and Practices

Accounting methods and practices encompass systems and procedures for recording and reporting financial transactions. Key approaches include the double-entry system and accrual vs. cash basis accounting.

Double-Entry System

The double-entry system is a fundamental method in accounting where every financial transaction is recorded in at least two accounts. This ensures that the accounting equation remains balanced. Each transaction consists of a debit and a credit, maintaining the equality of assets, liabilities, and equity. The system enhances accuracy and transparency in financial reporting by providing a clear audit trail. It is universally applied in modern accounting practices, forming the basis for preparing financial statements. The double-entry system is essential for maintaining balanced books and ensuring reliable financial data, as highlighted in fundamental accounting principles PDF resources.

Accrual vs. Cash Basis Accounting

Accrual and cash basis accounting are two primary methods of recording financial transactions. The cash basis recognizes revenue and expenses when cash is received or paid, while the accrual basis recognizes them when earned or incurred, regardless of payment timing. The cash basis is simpler and suitable for small businesses, but it may not provide a complete financial picture. The accrual basis offers a more accurate reflection of financial performance by matching revenues with related expenses, adhering to GAAP and IFRS principles. Businesses choose the method based on complexity, size, and compliance requirements, as outlined in fundamental accounting principles PDF guides.

Ethical Considerations in Accounting

Ethical accounting ensures transparency, honesty, and accountability in financial reporting. Professionals must adhere to moral standards, avoiding fraud and misleading practices to maintain public trust and integrity.

Professional Ethics and Transparency

Professional ethics in accounting are crucial for maintaining trust and integrity in financial reporting. Accountants must uphold honesty, objectivity, and confidentiality to ensure accurate and unbiased representation of financial data. Transparency involves clear disclosure of all material information, enabling stakeholders to make informed decisions. Ethical standards, such as those outlined in GAAP and IFRS, provide a framework for professionals to follow, promoting accountability and fairness. By adhering to these principles, accountants contribute to the credibility of financial statements and uphold the public interest.

Internal Controls and Fraud Prevention

Internal controls are essential for safeguarding assets, preventing fraud, and ensuring the accuracy of financial data. These controls include measures like segregation of duties, regular audits, and access restrictions to critical systems. By implementing robust internal controls, organizations minimize the risk of fraudulent activities and errors. Effective fraud prevention also involves promoting a culture of accountability and ethical behavior. Regular monitoring and evaluation of controls ensure their effectiveness, providing stakeholders with confidence in the integrity of financial reporting and operational processes.

Practical Applications of Accounting Principles

Accounting principles are applied in preparing financial statements, analyzing data, and making informed business decisions. They ensure accurate and transparent reporting, guiding stakeholders effectively.

Preparing Financial Statements

Preparing financial statements involves systematically recording and presenting financial data following accounting principles. The balance sheet, income statement, and cash flow statement are key components. Each serves a unique purpose: the balance sheet provides a snapshot of a company’s financial position at a specific time, the income statement summarizes revenues and expenses over a period, and the cash flow statement tracks cash inflows and outflows. These documents are essential for stakeholders to assess financial performance, make informed decisions, and ensure compliance with regulations. Accuracy and transparency are critical in their preparation to maintain credibility.

Analyzing and Interpreting Financial Data

Analyzing and interpreting financial data is crucial for understanding a company’s performance and making informed decisions. Key techniques include trend analysis, ratio analysis, and benchmarking. Financial statements such as the balance sheet, income statement, and cash flow statement provide essential data for analysis. By evaluating metrics like profitability, liquidity, and solvency, stakeholders can assess financial health. Accounting principles like GAAP and IFRS ensure consistency in reporting, enabling comparative analysis. Interpreting data accurately helps identify strengths, weaknesses, and opportunities, supporting strategic planning and accountability. Effective analysis requires a deep understanding of financial concepts and standards.